Schrödinger's Wallet

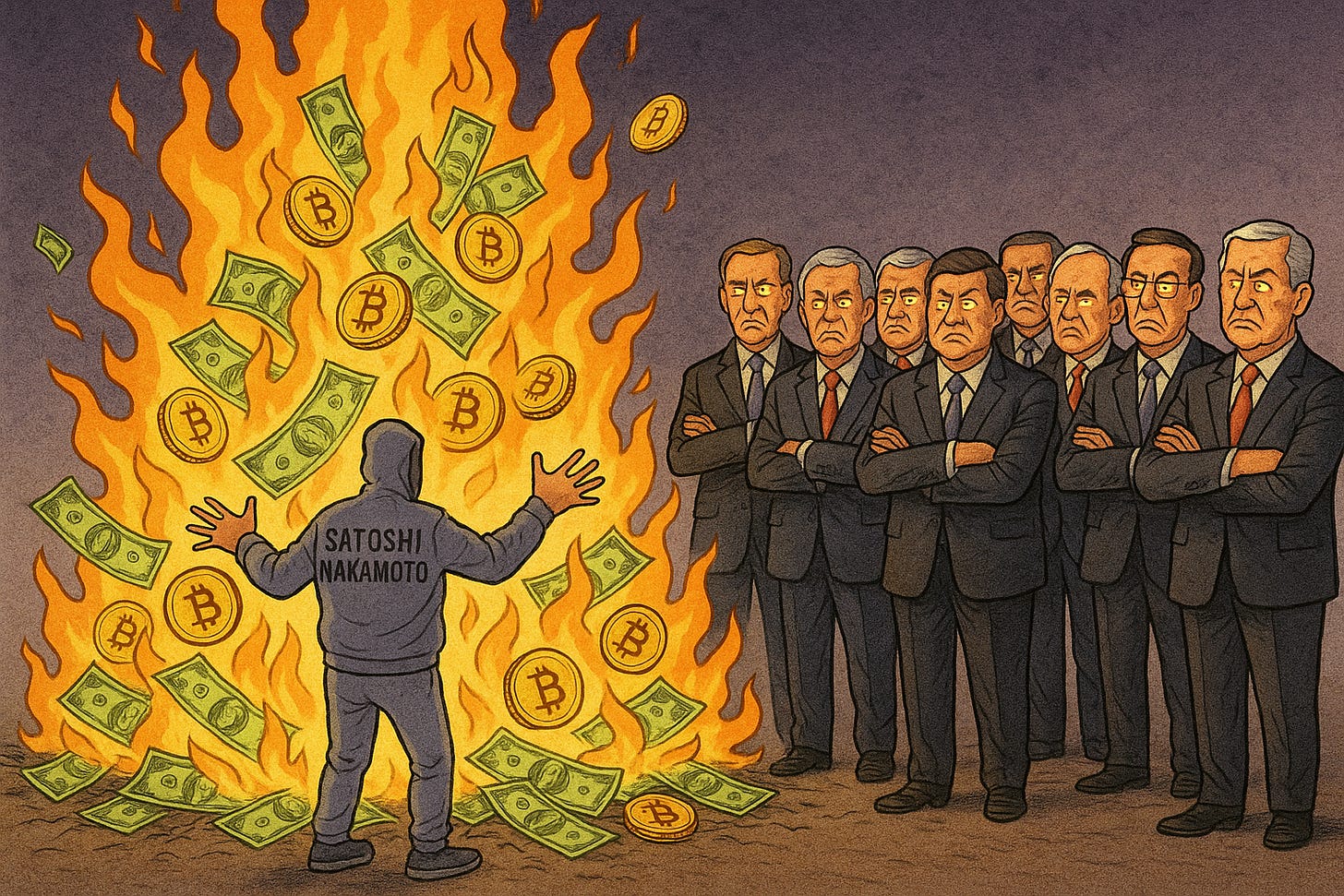

Why Satoshi's Shadow Blocks Sovereign Adoption.

The greatest irony of Bitcoin is that its creator's anonymity - once its greatest strength - has become its primary weakness for sovereign adoption. While Satoshi Nakamoto gave us programmable monetary policy, they left us with an unprogrammable monetary policymaker: himself.

China spent decades building dollar independence through gold accumulation, yuan internationalization, and bilateral trade agreements. Bitcoin offers everything they want: fixed supply with no adversary controlling it, global liquidity at a fraction of gold’s ToC. Yet they ban it. Why?

The answer may not be control, but uncertainty: China already controls what their citizens transact with. As for BTC/CNY in international markets, nothing apart from Satoshi uncertainty is holding them back from accumulating a large enough reserve.

Yet while every central bank governor understands the Fed's reaction function, nobody understands Satoshi's.

Those million dormant bitcoins represent a sword of Damocles over any reserve. Not because 5% supply matters mathematically, but because sovereign reserves demand certainty against meltdown. The Fed may print recklessly, but at least they announce it first. Satoshi’s wallets on the other hand could long squeeze China's reserves.

Bitcoin maximalists may insist Satoshi would never dump. Yet as John Mearsheimer puts it so well, states don’t play expected value, they play minimax. In a game of survival, every probability distribution starts looking like a fat-tail.

The solution is almost absurdly simple: burn the coins. Burning 90+% would transform Bitcoin from a speculative asset with sovereign potential into a sovereign asset with speculative upside, while taking Satoshi hadily into 3 commas club.

Imagine China announcing a Bitcoin reserve strategy the day after Satoshi burns 900,000 BTC. Every BRICS nation would scramble to accumulate. Not to stop Bitcoin, but to manage the on/off ramps while they build reserves. The US Treasury's monopoly on "risk-free" reserves would face its first real competition.

Satoshi gave us sovereign money. The final gift would be making it sovereignly adoptable. The code is already perfect. Time to perfect the politics1.

Perceived Assumptions

This argument can be perceived to rest on several assumptions. Let's examine them:

“China can control BTC/CNY” ⚡ “With a large enough reserve and domestic capital controls, anything is possible…”

"Satoshi still has access to their private keys" ⚠️ Unfalsifiable, but that's precisely the problem. Whether they have them or not, the world must assume they do. Schrödinger's keys.

"Burning Bitcoin is technically feasible" ✓ Already possible - send to addresses with no private keys. No protocol change needed.

"The ~1M BTC estimate is accurate" ✓ Early block analysis and the "Patoshi pattern" give us 95%+ confidence on most addresses.

"5% supply could trigger cascading liquidations" ⚠️ In today's 10-50x leveraged derivatives markets? A 5% spot move becomes a 50-250% paper move. Not impossible, hence enough to force minimax.

"China wants Bitcoin reserves but is blocked by uncertainty" ⚠️ Inference based on their gold accumulation strategy and dollar-independence goals. Plausible but unproven.

"Nation-states can't accept even small probability risks in reserves" ✓ This is textbook realist international relations theory. States play minimax, not expected value.

"Market has already priced in permanent dormancy" ⚡ Markets price in probability, not certainty. The difference matters infinitely to sovereign actors.

"Satoshi would be motivated to burn for altruistic reasons" ⚡ Someone who stayed anonymous while sitting on $100B+ clearly values mission over money. Character evidence suggests yes.

"BRICS would follow China into Bitcoin" ⚠️ Assumes continued dollar-alternative coordination. Current trajectory supports this.

"Burning wouldn't impact network security" ✓ 5% supply change is negligible to mining economics, especially with fee market maturation.

Legend:

✓ = Credibly addressed, no longer assumed

⚡ = Possibly refuted, still debatable

⚠️ = Still assumed

Let's hope Satoshi didn't actually lose those keys, because if they did, we're witnessing the cruelest joke in history of money & altruism: the person who sacrificed $100 billion to free us from arbitrary monetary policy can't prove their sacrifice. Even death wouldn't solve it - the keys could have been passed on.

For Satoshi, lost keys or burned coins mean the same thing: no wealth. For the world, it's the difference between eternal uncertainty and monetary finality. In other words, Schrödinger’s Wallet.